In a major milestone, India achieved the 100 GW of installed renewable energy (RE) capacity (this excludes large hydro) just a day ahead of its 75th Independence Anniversary. While this achievement is praiseworthy, there are some challenges that need to be overcome before India can make a smooth ride to achieving its ambitiously stated 175 GW target by 2022 which looks difficult or nearly impossible to achieve or a 450 GW target by 2030.

No mean feat

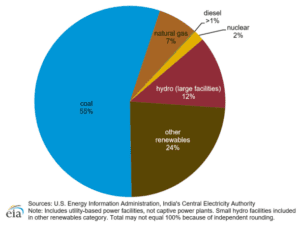

Nevertheless, the 100 GW achievement is no mean feat. Globally, India is now ranked fifth in solar and fourth in wind in terms of installed capacity. Both solar and wind capacities have quadrupled in the last ten years. Overall, RE capacity has grown at an annualized rate of 10 per cent in the last decade. Thanks to concerted efforts, RE (excluding large hydro) now contributes to one-fourth of the overall installed capacity base in India. While 100 GW has been installed, 50 GW is under installation and 27 GW is under tendering. India’s renewable expansion is already hailed as one of the largest renewable capacity expansion programs in the world.

This has been enabled through progressive policies, both at the central and the state level, low solar and wind tariffs that encouraged utilities to procure renewable energy, as well as better planning, financing and structuring of projects. Of late, Covid-19 did act as a dampener of sorts, but the renewable sector has demonstrated remarkable resilience in the last two years in the ongoing challenging times of the pandemic.

Growth drivers

This has been enabled through progressive policies, both at the central and the state level, low solar and wind tariffs that encouraged utilities to procure renewable energy, as well as better planning, financing and structuring of projects. Of late, Covid-19 did act as a dampener of sorts, but the renewable sector has demonstrated remarkable resilience in the last two years in the ongoing challenging times of the pandemic.

India’s increasing energy demand has also helped grow the cause for RE. As per the International Energy Agency, by 2030 India will overtake the European Union as the world’s third-largest energy consumer. The record low tariffs discovered through RE sector bids has also lead to RE getting a distinct cost advantage as compared to other fuels. The new RE technologies have consistently brought down costs and increased efficiency. The Indian renewable sector should continue to outperform the thermal sector given its cost advantage and its enormous environmental friendliness.

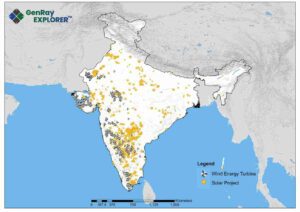

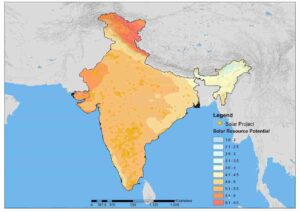

In solar particularly, rooftop solar aided by net metering along with innovative solutions such as floating and canal-based solar added to the growth momentum. Besides, proposed solar cities and parks are helping in adding large capacities. 47 solar parks of aggregate capacity of 23,499 MW had been sanctioned across 17 states. Solar Parks in Pavagada (2 GW), Kurnool (1 GW) and Bhadla-II (648 MW) are among the top 5 operational solar parks of 7 GW capacity in the country.

Challenges Ahead

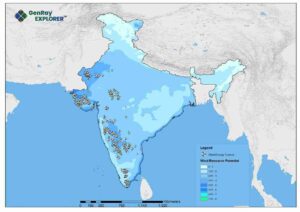

A number of challenges lie in the road ahead. Lack of clarity on bidding pipelines is often cited by experts as stumbling block in better planning. Steeply falling tariffs to as low as INR 2 per kWh is discouraging developers to bid for projects as margins are highly squeezed. While low tariffs towing to a well-functioning competitive market is good for electricity buyers, it is not lucrative for developers. Such low tariffs are unable to leave much scope to incorporate margins to account for currency fluctuations and generation risk due to unpredictability of the key resource , be it wind or solar irradiation.

Besides, a major challenge is the weak financial health of distribution companies. These companies need to be able to make timely payments. Local manufacturing capacity is still inadequate. India is largely import dependent when it comes to solar modules, batteries for power storage and for manufacturing other renewable energy systems.

Also, renewable energy sector financing in India comes with its own set of challenges including high interest rate on loans that range from 12-15 per cent compared to countries such as the US and Europe where it is in the range of 5-7 per cent or even lower. Long-term fixed rate debt at competitive rates can help developers gain competitive edge and viability.

There are also delays in land-acquisition accentuated by lack of resource-rich sites, increasing land prices and complicated land transfers. Transmission constraints and mismatches in generation and transmission development too leads to uncoordinated development. Besides, of late Covid-19 has led to delays in tendering, procurement and construction.

To sum up, the milestone should only motivate India to move towards its ultimate goal of significant transition to clean energy. India’s stated objective is to achieve 40 per cent of its installed base through non fossil based resources by 2030. This is doable, provided impediments are removed and a facilitating environment provided for a smoother transition.