In December 2023, the Indian government initiated a strategic update to its wind energy policy, specifically targeting the repowering of ageing wind turbines to augment the nation’s wind energy output. This revised directive facilitates the enhancement and life extension of older turbines, which were previously constrained by limited capacity and structural elevation, thereby enabling an increase in energy generation.

Key Points of the Repowering Policy of 2023

The 2023 Repowering and Life Extension Policy for Wind Power Projects in India aims to enhance the nation’s wind power capacity by optimizing wind energy resources. Here are the key points extracted from the policy document:

- Purpose and Scope: The policy enables the replacement of older turbines with newer, more efficient models even before the end of their design life, if owners choose to. It also allows for the refurbishment of wind turbines to extend their life beyond the design life based on safety and performance assessment according to relevant standards .

- Repowering Potential: The National Institute of Wind Energy (NIWE) estimates the country’s repowering potential at 25.406 GW for turbines below a 2 MW capacity. A detailed repowering potential map will be issued by NIWE .

- Eligibility Criteria: Turbines eligible for repowering or refurbishment under the policy include those not complying with the quality control order, those that have completed their design life, turbines of rated capacity below 2 MW, and turbines that can be commercially or voluntarily considered after 15 years of installation .

- Project Categories: Repowering projects are categorized into Standalone Projects (single or group of turbines owned by a single entity) and Aggregation Projects (group of turbines with shared infrastructure owned by multiple owners) .

- Implementation Framework: A Wind Repowering Committee (WRC) will be established to facilitate effective implementation and address policy or regulatory interventions .

- Power Purchase Arrangements: The generated power from repowered or refurbished turbines will continue to be procured as per existing PPA terms, and additional power can be sold at the owner’s discretion without an obligation to supply to any DISCOM/procurer at fixed rates .

- Incentives: Loans from REC/PFC/IREDA are available on the same terms as new projects, with an additional interest rate rebate of 0.25% for repowering projects. All fiscal and financial benefits available to new wind projects will be applicable to repowered projects as well .

- Data Management and Reporting: NIWE will maintain a project database and collect performance data to identify sites for repowering or refurbishment .

- Commissioning Schedule: Repowering and refurbishment projects must be commissioned within 24 months from the date of the consent letter from CNA/SNA or consumer entity. Early and part commissioning are permitted .

- Amendments and Reviews: The Ministry of New & Renewable Energy has the power to amend or review the policy to ensure effective implementation and address any arising difficulties .

- Financial Considerations: Repowering Project Aggregators (WRPA) may incur costs for decommissioning and disposal, partly compensated by the income from the sale of scrap material. A detailed methodology for calculating the ‘Repowering Site Preparation Cost (RSPC)’ is provided .

- The policy underscores India’s commitment to enhancing its wind energy infrastructure by providing a clear framework for the repowering and life extension of existing wind turbines.

The Challenges Persist

Crafted in synergy with pivotal industry stakeholders, who are integral to a national committee tasked with its implementation, the policy addresses a persistent demand within the sector. However, the process of repowering involves intricate challenges, including elevated capital outlays, expanded land and infrastructural requisites, and the imperative for consensus among all stakeholders in collaborative ventures.

The financial incentives proffered by the Union government are comparatively minimal, necessitating supplementary fiscal encouragement from state governments to motivate wind farm proprietors to embark on repowering initiatives. Such state-level incentives are crucial for India to meet its audacious objective of achieving net-zero emissions by 2070.

India’s Wind Sector and Repowering Needs

India’s commitment to secure 50% of its electricity generation capacity from non-fossil sources by 2030 appears achievable ahead of the deadline, with wind energy playing a pivotal role—accounting for 10.4% of the country’s non-fossil fuel capacity. This is in concert with other renewable sources such as solar and hydro.

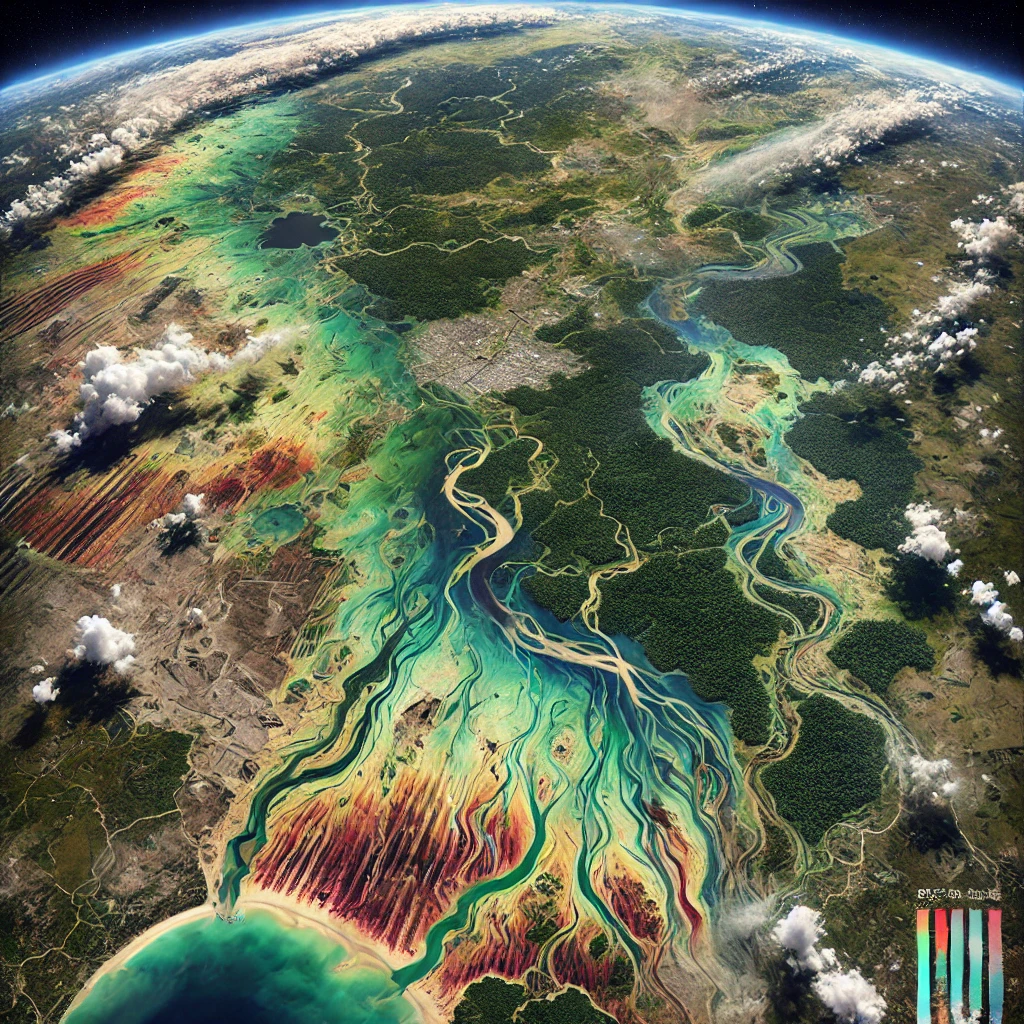

A significant portion of India’s turbines, installed pre-2000 and predominantly under 1 MW, occupy sites characterized by high wind potential yet are approaching or have exceeded their designed operational lifespan. By augmenting the structural height, increasing rotor diameters, and upgrading additional components, these turbines can be recalibrated for heightened efficiency and extended service life.

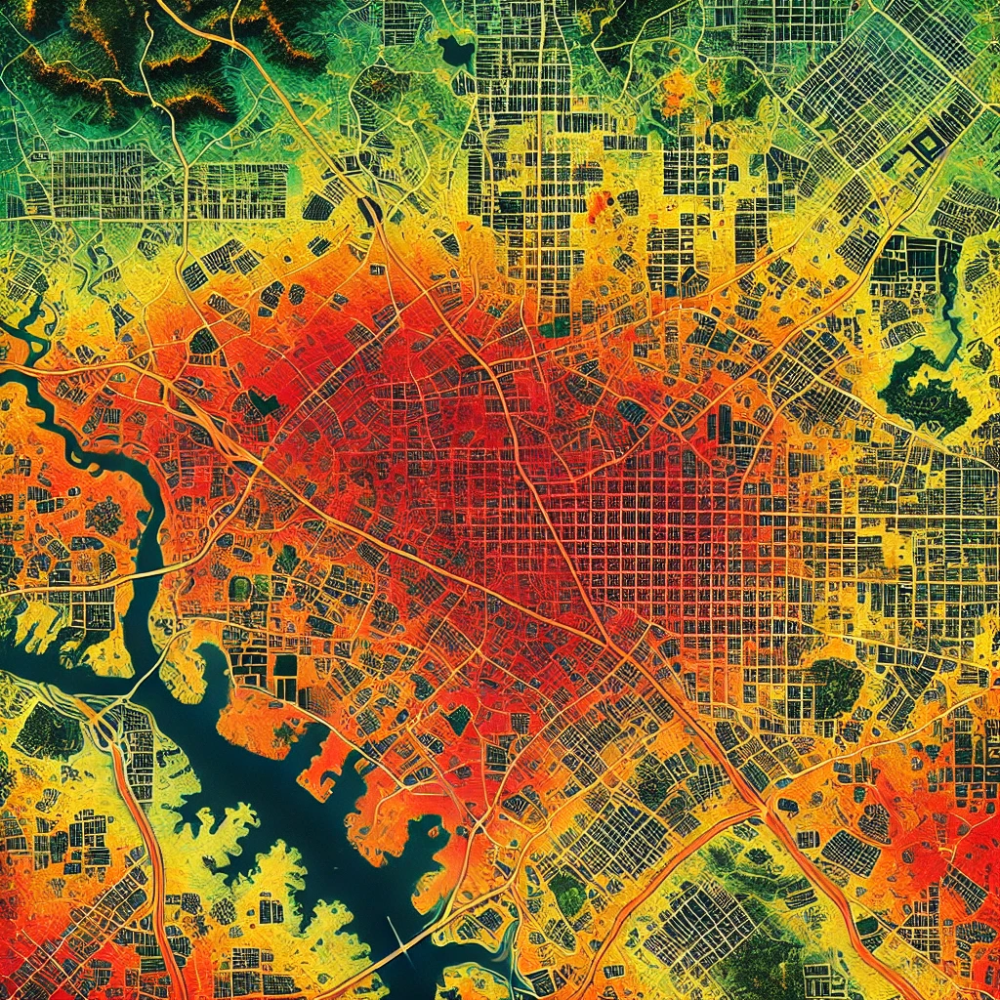

Statewise Repowering Potential Identified by NIWE

Source: MNRE, WhereSciences GeoSpatial Labs Research

Repowering Success in Europe

The efficacy of repowering has been well-documented in the European context, where facilities like Spain’s El Cabrito Wind Farm and Denmark’s Nørrekær Enge and Klim Fjordeholme Wind Farms have reported marked enhancements in energy output subsequent to repowering.

The Indian Renewable Energy Development Agency (IREDA) is geared to facilitate this transition through specialized financial products designed for repowering, inclusive of additional interest rate rebates. Concurrently, the state government of Tamil Nadu is formulating its bespoke repowering policy, indicative of the tailored approaches required to address regional disparities within India.

The Road Ahead

With the central government’s policy revision and enhanced support from various state initiatives, there emerges a viable trajectory for rejuvenating India’s aged wind turbines, thereby potentially invigorating the national wind energy sector and making substantial contributions towards the country’s renewable energy targets. Nevertheless, the realization of this potential will depend critically on surmounting significant operational and fiscal barriers to ensure the widespread adoption and successful implementation of repowering strategies.