Phenomenal Transition

Vietnam is one of the most efficient power markets in Southeast Asia, driven by low-cost resources such as hydro and coal. This southeast Asian country has achieved around 99 percent electrification with relatively low costs in comparison to neighbouring countries.

But what is perhaps a stark and recent feature of its energy growth story is its phenomenal transition from a coal dominant economy to renewable energy economy. The country, which depends on coal, hydro, gas oil, solar and wind is now leaning heavily towards renewable sources for growing its energy sector. From 0.76 per cent of the installed energy base in 2018, renewable installations jumped to 11 per cent in 2019 and it stood at an enviable 14 per cent in 2020. To be precise, 2018 to 2019 marks a jump from 97 MW of solar and 292 MW of wind capacity to an incredible 5.5 GW of solar and 454 MW of wind capacity.

Wind capacity continues to show a surge, buoyed by tremendous wind potential both onshore and offshore. As per Asia Wind Energy Association, Vietnam’s wind energy potential is higher compared to Thailand, Laos or Cambodia. Around 28,000 square kilometres of Vietnam have average wind speeds of 7 m/sec to 9 m/sec at a hub-height of 65 meters. Vietnam’s onshore wind potential is 42 GW, but its offshore wind potential is 214-261 GW. As of March 2021, the total wind capacity is has grown to 537 MW with nine wind projects already operational in the country. Another 18 are likely to be added in 2030, mostly in the southern and central parts of the country.

Comparison – Renewable Energy generation (GWh) 2018 vs 2020

Reason for the Big Switch

Apart from the impressive potential, there are several government-driven reasons for the growth of wind sector. One is the introduction of attractive tariffs. In 2011, the feed-in tariffs (FIT) introduced were 7.8 $c per kwh. However, this was not attractive enough. In the revised new tariff implemented in 2018, called FiT2, the onshore tariff was kept at 8.5 $c per kwh while the offshore tariffs were 9.8 $c per kwh.

There was tremendous progress after the implementation of revised tariffs, with the wind capacity surging to 537 MW in 2021. The FiT2 will expire by October 2021. The government is looking at two options – either to expand the tariff system or look at the option method to call the investors. The government also issued Power Purchase Agreement (PPA) regulation in January 2019 on wind power project development and standardised PPAs for wind projects. Besides, aggressive RE policies incentivizing the developers at practically all stages of development cycle has also accelerated this switch.

Outperforming Government’s targets

Interestingly, the Power Development Plan (PDP) VII that came out in 2016 had set a target to increase the share of renewables in power generation to 7 per cent by 2020 and 10 per cent by 2030, and Vietnam out-performed these targets. Now, the country has revised its clean energy targets in draft PDP VIII, 2021 especially aiming to leverage its offshore wind potential.

Under the new PDP, Vietnam expects to add 17 GW of wind capacity in the next 10 years, of which 15 GW will be onshore and 2 GW will be offshore. Given the infrastructure challenges that come with offshore projects, the focus will be on onshore and near-shore projects for the time being. The first near shore wind project was commissioned in 2016. Similar projects are now being commissioned in Tra Vinh, Ben Tre, Soc Trang and Bac Lieu. By end of this year, 400 MW of such projects are likely to be in operation.

Huge Pipeline of Offshore Wind Projects Under Development

Currently, Vietnam has 116 offshore wind farm projects under different stages of concept, approval, development and operation out of which two offshore wind farms 83.2 MW Bac lieu – II and 16 MW Bac lieu – I are already fully commissioned, 75 MW Tan Thuan PECC 2 – I offshore farm partially operational, 100 MW Dong Hai I & II farm, 142 MW Bac lieu – III, 30 MW Ben Tre V1-3, 31.5 MW Ben Tre 5 all under advanced stages of construction and 29 projects under various stages of concept, approval and development.

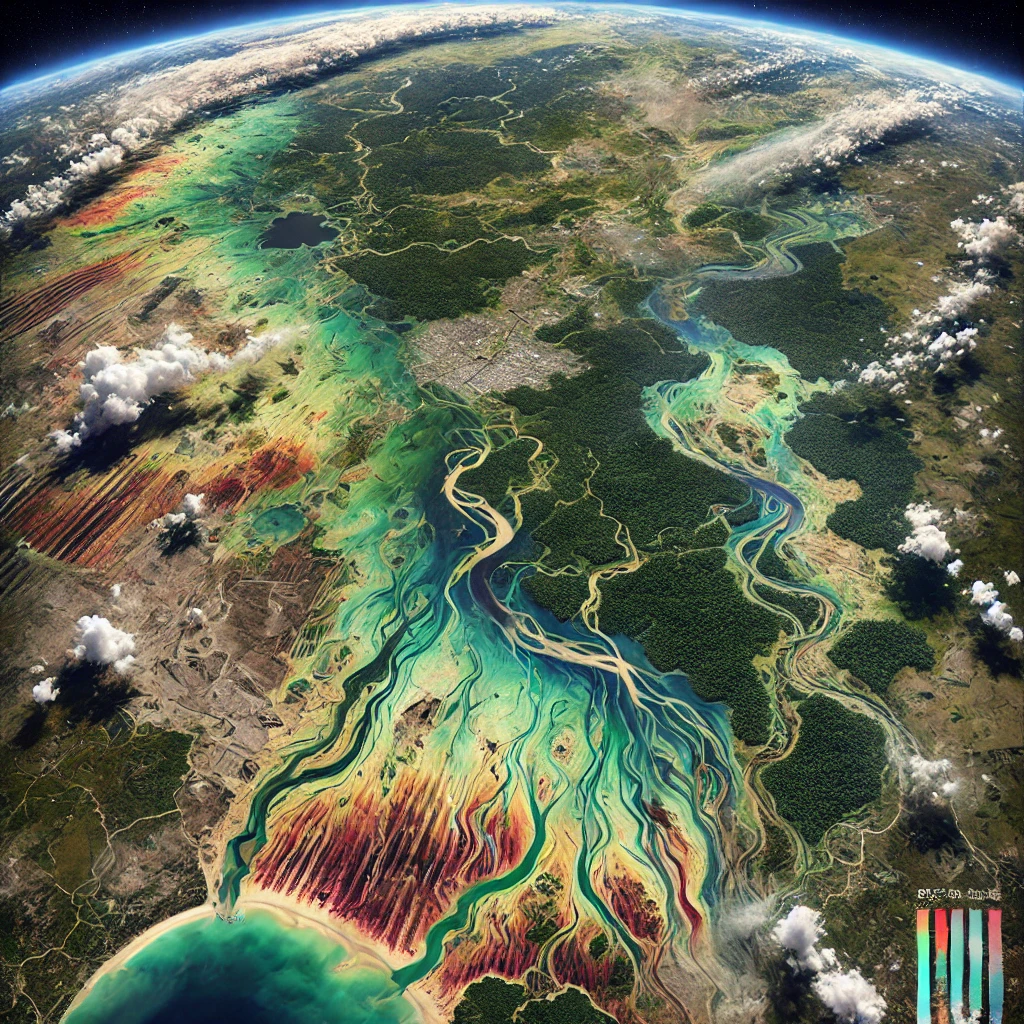

Offshore Wind Potential

Vietnam has a vibrant and abundant offshore wind resource that lies near the demand centres and in relatively shallow waters. Most of the targeted offshore wind capacity is located in Southern Vietnam. Estimates suggest that offshore wind sector alone has the potential to supply 12 per cent of Vietnam’s electricity by 2035. By replacing coal-fired generation, this could help to avoid over 200 million metric tons of CO2 emissions and add at least US$50 billion to Vietnam’s economy by stimulating the growth of a strong local supply chain, creating thousands of skilled jobs, and exporting wind power.

Given the infrastructure constraints in deeper waters, the primary focus first would be to harness the offshore wind potential in the shallow water regions despite the fact that locations further offshore have higher wind speeds and energy yields.

As per offshore wind roadmap 2021 by World Bank, the offshore wind energy generation is expected to be 30 TWh by 2030, 170 TWh by 2040 and 330 TWh by 2050. This generation has potential to replace nearly 4.2 GW of coal projects by 2030 saving 22 MT of CO2 , replacing 22.8 GW of coal projects and saving 88 MT of CO2 by 2040 and replacing 47 GW of coal projects and saving 154 MT of CO2 by 2050 (coal PLF averaged at 80%).

Offshore Wind Statistics Vietnam

Roadmap for Offshore Wind Development

The draft PDP VIII 2021 by Ministry of Industry and Trade (MOIT)), has laid out an aggressive clean energy plan for Vietnam’s power sector including very ambitious development of offshore wind capacity targets by 2045. The ministry through its draft PDP VIII has published a detailed list of upcoming prospective offshore wind projects in region. The central, south central and southeast region of Vietnam is expected to achieve 44.6 GW while the southwest region is expected to achieve 15.1 GW of offshore wind projects over a span of 25 years (till 2045). The PDP VIII estimates the offshore wind projects to grow at a CAGR of 16.9 per cent between the years 2030 and 2045 in low power demand scenario and at a CAGR of 18.01 per cent in the high demand scenario during the same period.

Renewable Energy Installed Capacity (MW) Growth

Bottlenecks in Offshore Wind Projects Development

Offshore wind like any other technology has its own set of challenges and limitations which includes primarily:

- Resource intermittency/variability

- Development and deployment of geography specific technology

- Higher cost per unit generation in a developing market

- Lower feed-in tariffs

- Underdeveloped transmission grid

- Dearth of skilled human resource

Among all these factors, lower feed-in tariffs is perhaps the biggest irritant that has disappointed foreign developers as offshore wind projects have high infrastructure cost. Besides, this the time taken to execute the PPAs with Vietnam Electricity (EVN), the largest power company and nationality utility in Vietnam is very high. The delays further leads to increase in project costs.

The grid from Ho Chin Minh City to south central is relatively strong. However, the grid from central to northern Vietnam is not as robust. The maximum grid voltage in Vietnam is 500 kV. Underdeveloped grid also adds to the concern. There is a need to build ultra-high voltage lines from North to South. EVN has recently announced that the construction of new transmission lines might not be able to match the pace of new solar and wind power projects. This could translate into considerable curtailments of upcoming RE projects. However, one major grid development project underway is a 461-mile transmission line extension with three 500-kilovolt transmission lines that will connect nine cities and provinces across central and southern Vietnam.

There are some other factors that need to be put in place as well. These include a robust leasing and permitting infrastructure which ensures the system is well equipped to manage the expected increase in volume of wind and solar projects seeking permits and clearances, innovative project financing pathways which help reduce the cost of capital for offshore wind projects, comprehensive skill development initiatives to train the local population for a seamless supply chain and finally developing a strict safety and environmental regulations derived from offshore oil & gas good practices for safeguarding the workers and the environment in and around the projects.

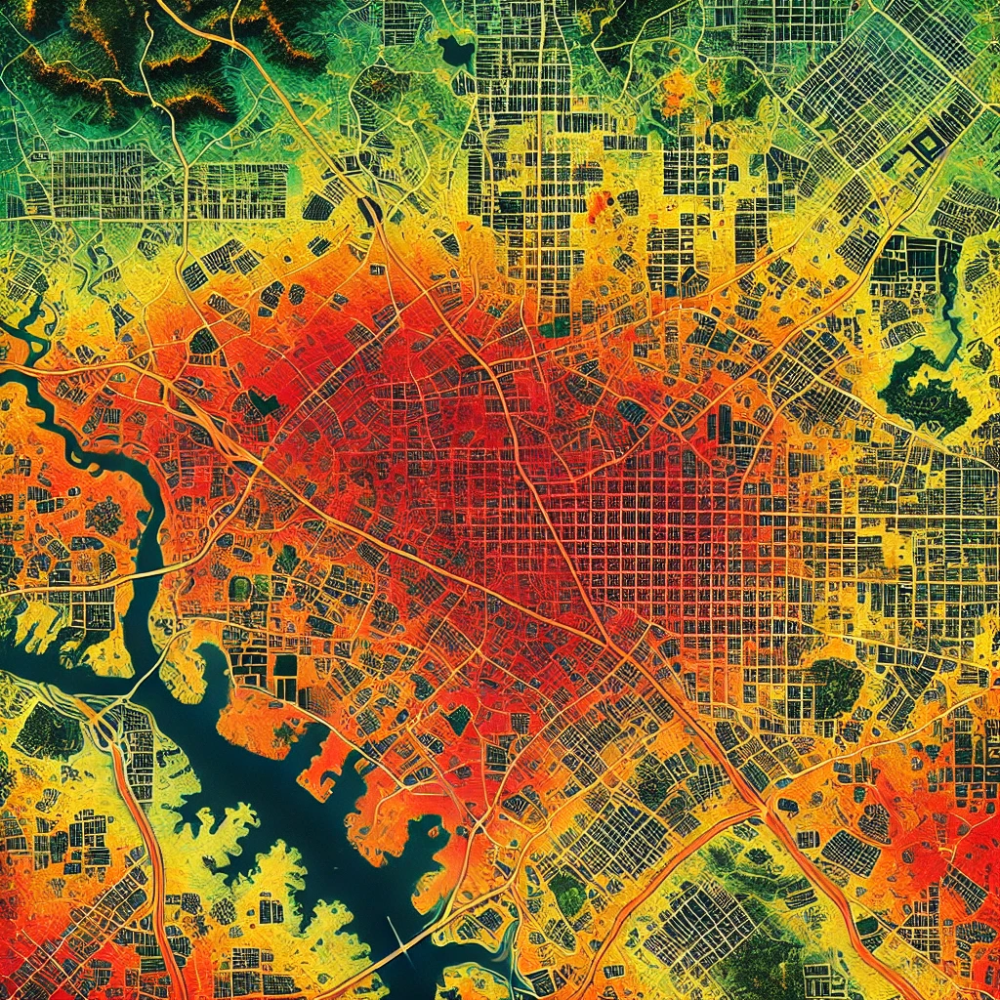

Role of Spatial Mapping and Analytics developed by WhereSciences GeoSpatial Labs Energy

Spatial mapping and analytics plays a huge role in assessing the suitability of sites. The Site Suitability Module embedded in GenRay ExplorerTM tool developed by WhereSciences GeoSpatial Labs Energy, a Singapore based Research and Analytics Company, helps in providing detailed site suitability analysis for onshore wind and solar project developers including both the technical and non- technical factors. Apart from site suitability analysis, users can also scan through the existing and under construction solar and wind projects, substations, transmission lines in the and around Vietnam to have an elaborate understanding of the energy landscape.

As per WhereSciences GeoSpatial Labs Energy experts, just an assessment of technical factors such as wind speed, slope, water depth etc. are not enough to finalize the selection of sites for offshore wind projects. Various social, environmental and economic constraints need to be considered. A detailed analysis on biodiversity of the area and offshore ecosystems needs to be spatially analysed to avoid sub- optimal site selection.

Bin Thuan and Phu Lac Wind Farms

In Site Suitability Module of GenRay EXPLORER™, various social, environmental and economic constraints are considered. A detailed analysis on biodiversity of the area and offshore ecosystems are spatially analysed to avoid sub-optimal site selection.

Key Takeaway

The development of offshore wind would not only mitigate Vietnam’s energy security concerns but also portray Vietnam as a leader in clean energy transition amongst the Southeast Asian counties. Further, it promises to give a major boost to the overall economy of Vietnam by adding new skills and employment opportunities contributing to nation building. However, improved grid infrastructure, removing transmission constraints, managing RE curtailments, limiting utility monopolies and wafer-thin margins to the developers are some of the concerns that needs to be urgently addressed for Vietnam’s superlative performance in achieving its ambitious renewable energy targets.